Trade Questions, Slow Leasing Hold Back Warehouse Dealmaking

A wave of new buildings, weak demand and economic uncertainty are weighing on sales of warehouses, experts say

Industrial deal volume was roughly flat in the second quarter of 2025 after double-digit growth the previous two quarters, according to data provider MSCI. Photo: Paul Hennessy/Zuma Press

Investors are taking a more cautious approach to buying and selling warehouses amid rapidly shifting trade policy, an uncertain economic outlook and an abundance of available space.

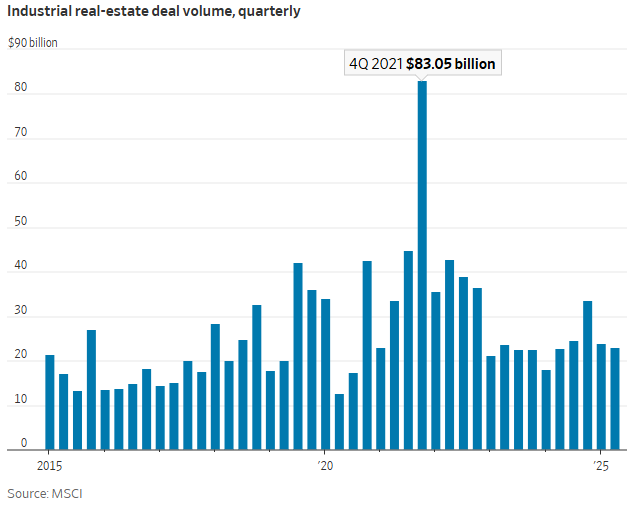

Industrial deal volume was roughly flat at $22.87 billion in the second quarter of 2025 compared with the same period of 2024, a dramatic slowdown after double-digit growth the previous two quarters, according to data provider MSCI.

The Trump administration’s on-again, off-again tariff rollout has slowed decision-making as business leaders wait to see the outcome of new trade policy.

Jim Costello, head of Americas real-estate research at MSCI, said beyond the new duties, investors already had concerns about the warehousing market.

Warehouse operators over the past three years have grappled with slow leasing activity as retailers, manufacturers and other tenants take a more cautious approach to new space following a period of frenetic expansion during the pandemic. At the same time, a flood of new buildings constructed since the pandemic have hit the market and driven up the availability of space.

“We had a supply shock,” Costello said. “You’ve got a market that was already showing some weakness, with questions about what happens in the future to demand given all the challenges from tariffs.”

Here is a look at the state of the industrial real-estate deals market in charts.

Industrial deal volume cools off

Many investors coming into this year expected there would be “an expansion in tenant space demand and vacancies coming down, [as well as] rent growth reinvigorating,” said Juan Arias, national director of U.S. industrial analytics at real-estate analysis firm CoStar Group.

Arias said the Trump administration’s tariff rollout froze some dealmaking.

“The uncertainty is what’s keeping business decisions from getting made,” he said.

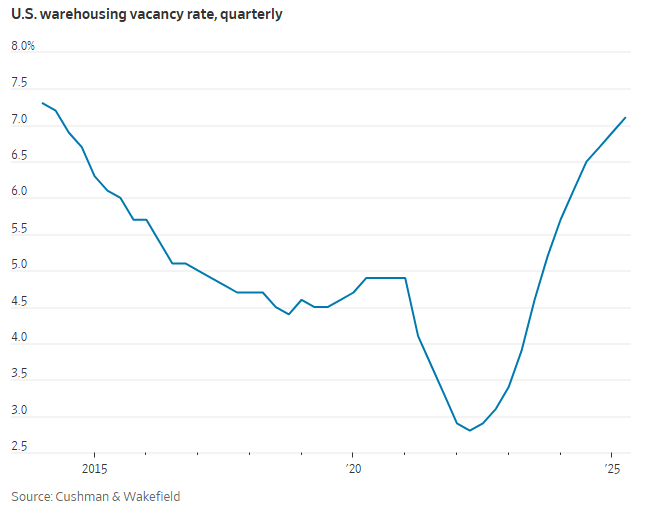

Vacancy rises to highest level in a decade

The average warehouse vacancy rate across the U.S. ticked up to 7.1% in the second quarter, the first time the vacancy rate surpassed 7% since 2014, according to commercial real-estate services firm Cushman & Wakefield.

John Huguenard, co-lead of the industrial capital markets group at real-estate services firm JLL, said increased availability has weighed on investors deciding whether to buy vacant properties.

“It’s hard to figure out, what is that lease-up time frame?” Huguenard said. “If I have vacancy in a building, or I have a vacant building, is it going to take me—it used to be six months of downtime, then it was nine, then it was 12, now it’s 12 to 18.”

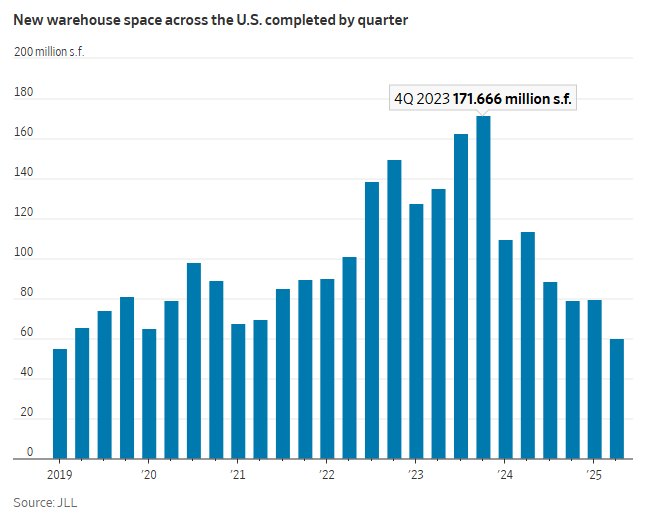

Newly completed warehouses fall to lowest point since 2019

About 1.9 billion square feet of new warehouse space has gone up across the U.S. over the past four years, according to JLL, roughly equal to the size of Washington, D.C.

Developers have more recently pared back new projects due to slow leasing activity. Nearly 60 million square feet of new warehouse space completed construction in the second quarter, down 47% from the previous year to the lowest level since the first quarter of 2019, according to JLL.

But even with less new supply hitting the market, MSCI’s Costello said weaker tenant demand and the wave of new buildings have been “enough to cool some frothiness of investor interest in the sector.”

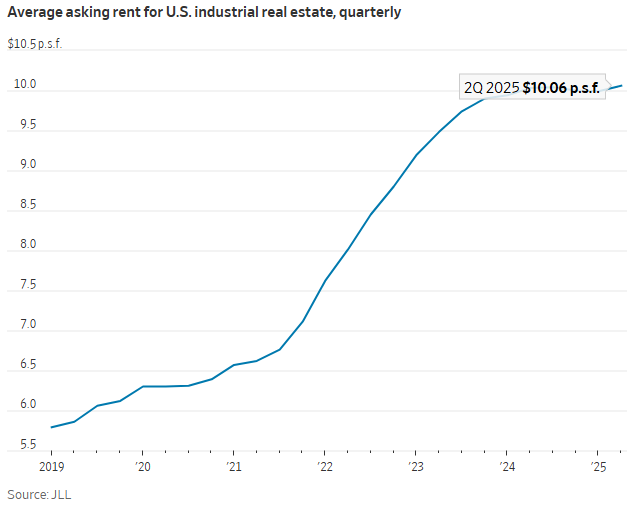

Average asking rents grow at slower pace

Rent growth accelerated during the pandemic and pushed up the cost of warehousing space significantly from the average asking rent of $5.96 per square foot in 2019, according to JLL.

That growth has slowed more recently. The average asking rent for industrial space climbed to $10.06 a square foot in the second quarter, up slightly from $9.99 the previous quarter and $10.03 a year earlier, according to JLL.

“There’s a pullback in demand from investors for warehouse space because there’s a lot of uncertainty around that rent growth picture,” said CoStar’s Arias.

Write to Liz Young at liz.young@wsj.com